The Unlikely Tech Titan That Has Outperformed Google, Apple, and Microsoft

The secret to turning $10,000 into $2 million. (Just kidding. There is no secret, only the opportunity.)

In the spring of 2007, while Wall Street was happily oblivious to impending doom, a quiet event on the Toronto Stock Exchange occurred unnoticed by American investors.

A small Canadian software company, dismissed by most as a regional curiosity, debuted publicly to domestic investors. Few could have imagined that this unheralded IPO would go on to outpace nearly every major U.S. tech stock, turning early believers into millionaires while rewriting the playbook for compounding wealth.

An Enigmatic Company and Its Enigmatic Founder

Mark Leonard is the mastermind behind Constellation Software, a Canadian tech empire that has quietly amassed a portfolio of over 500 vertical market software companies and an equity market cap north of $75 billion to make it one of the most valuable software conglomerates, yet one of the least talked about outside of business circles.

Leonard’s journey is anything but pedestrian. Before Constellation Software, Leanard spent years dabbling in a variety of occupations — banker, valuator, mason, gravedigger, dog handler, bouncer, and even wind energy researcher. After the oats were sufficiently sown, Leonard acquiesced to improving the gray matter and earned a bachelor’s degree from the University of Guelph and an MBA from the University of Western Ontario. He then cut his teeth in venture capital for over a decade before realizing he was allergic to the industry’s cultural short-termism.

In 1995, Leonard launched Constellation Software with a simple but radical idea: acquire niche, “boring” software companies that everyone else ignored, and let them run themselves. He gave founders and managers near-total autonomy, trusting them to keep their businesses humming while he focused on capital allocation and long-term growth. This hands-off approach earned him the nickname “Monk of the Market.”

All the while, Leonard kept the profile low. He is famously private — rarely granting interviews or appearing publicly — and shields his personal life from scrutiny. Leonard is something of an eccentric, sporting a beard that would qualify him for a side hustle in a ZZ Top tribute band. But why would he care? With a net worth in the billions and a reputation that rivals Warren Buffett, Leonard proves that sometimes the quietest minds build the loudest empire.

Business Model: The Engine of Growth

Constellation’s success is rooted in its disciplined acquisition strategy. The company targets small, specialized software businesses that serve niche markets, such as healthcare, construction, logistics, and the public sector. These businesses are typically mission-critical for their customers, resulting in high retention rates and predictable recurring revenue.

Operational Excellence and Financial Discipline

Once acquired, Constellation applies rigorous operational discipline to its portfolio companies. This includes optimizing pricing, cross-selling products, and sharing best practices across the organization. The company’s decentralized structure ensures that local management retains autonomy, which drives innovation and customer satisfaction.

Moderation also plays a role. Constellation practices conservative financial management. The company maintains a strong balance sheet, with ample cash reserves and manageable debt levels. This financial strength enables Constellation to continue its acquisition spree even during economic downturns.

Growth Drivers and Competitive Advantages

Constellation’s focus on mission-critical, niche software solutions create a durable fortress. Customers are less likely to switch providers for software that is deeply embedded in their operations. This “capturing” produces high retention rates and predictable recurring revenue.

Disciplined Capital Allocation

Constellation’s disciplined approach to capital allocation is a key driver of its success. The company reinvests the majority of its free cash flow into new acquisitions, ensuring that growth is both organic and inorganic. And a company whose gross margin averages 95% is apt to produce a lot of free cash flow. Asset-light Constellation is no exception.

Free Cash Flow (USD, millions):

CAGR (2017–2024): ~37.9%

Scale and Operational Leverage

As Constellation has grown, it has achieved significant operational leverage. The company’s centralized back-office functions and shared best practices allow acquired businesses to operate more efficiently, driving margin expansion and profitability.

Constellation Software turns acquisitions into long-term growth through a disciplined, decentralized, and empowering strategy that is rare in the software industry. Here’s how it works:

Vertical Market Focus: Constellation targets small, profitable software companies serving specific industries—like healthcare, government, or real estate—where software is essential to daily operations and customer loyalty is high.

Autonomous Operations: After acquisition, Constellation allows these companies to operate independently, preserving their culture, expertise, and management teams. This autonomy fosters innovation and agility, as local leaders know their customers and markets best.

Decentralized Capital Allocation: Capital allocation decisions are pushed down to the managers of acquired businesses, who are incentivized to reinvest profits wisely and pursue new opportunities. This decentralized approach speeds up decision-making and aligns incentives across the organization.

Buy and Never Sell: Constellation rarely divests acquired businesses. Instead, it holds them indefinitely, compounding cash flow by reinvesting profits into new acquisitions and internal growth initiatives.

Long-Term Perspective: The company prioritizes sustainable growth and profitability over quick wins, giving acquired businesses the stability and resources to focus on long-term development.

By combining these elements — focusing on niche markets, empowering local leaders, and reinvesting cash flow — Constellation has built a diversified, resilient portfolio that grows steadily and consistently, year after year.

Constellation’s “buy and build” strategy, combined with its focus on niche markets and decentralized management, has created a diversified, resilient portfolio that generates strong, consistent returns for its shareholders. Its ability to find undervalued, overlooked software firms, empower them to thrive, and reinvest profits into new acquisitions has made Constellation one of the most successful and respected software companies in the world.

Constellation has acquired over 500 businesses since its founding. Most acquisitions are small (under $5 million USD), but the company has also completed larger deals, such as the $250 million acquisition of Acceo Solutions in 2018 and the $700 million acquisition of Allscripts’ hospital business unit in 2022. These deals have expanded Constellation’s reach and deepened its expertise in key verticals.

Financial Performance: U.S. Dollar Metrics

Revenue Growth

Constellation’s revenue has grown from approximately $300 million USD at IPO to over $10 billion USD in 2024—a more than 30-fold increase. (Though Canadian, Constellation reports in US dollars.)

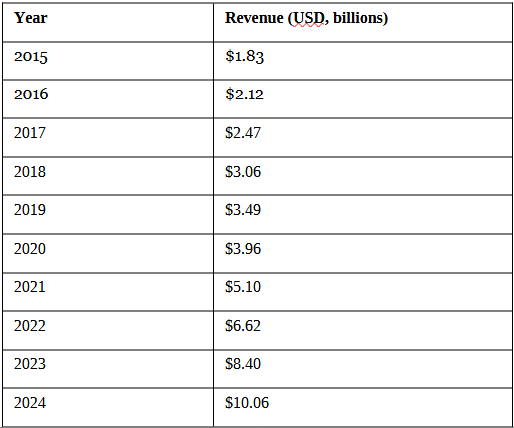

Recent Decade (2015–2024) Revenue (USD, billions):

CAGR (2015–2024): ~20.8%

Earnings and Profitability

Constellation’s net income and earnings per share (EPS) have grown at a similarly impressive pace. The company does not always report EPS directly in its filings, but it can be calculated from net income and shares outstanding.

Net Income and EPS (USD, approximate):

CAGR (EPS, 2015–2024): ~20.2%

Note:

When a company’s Earnings Per Share (EPS) grows faster than its net income, it usually points to changes in the number of shares outstanding. But in Constellation Software’s case, the story is a bit more nuanced.

What’s Going On with EPS?

1. Stable Share Count

Constellation has maintained a remarkably consistent share count (~21.19 million shares) for over a decade.

Unlike many public companies, it hasn’t issued new shares or conducted buybacks, so no dilution or artificial EPS inflation from fewer shares.

This rules out the most common reason for EPS outpacing net income: share buybacks.

2. Currency Translation Effects

Constellation reports in USD, though nearly half of its revenue and income paid in other currencies.

EPS is often reported in USD, and favorable exchange rates can amplify EPS growth relative to net income growth in CAD terms.

3. Shift in Earnings Mix

Over time, Constellation has acquired higher-margin businesses, improving profitability per dollar of revenue.

This operational leverage can lead to EPS compounding faster than net income if reinvested capital earns high returns.

4. Minority Interest Adjustments

Some of Constellation’s subsidiaries are not 100% owned. Net income includes earnings attributable to non-controlling interests.

EPS, however, is based on net income attributable to shareholders, so if the share of earnings attributable to Constellation shareholders increases, EPS can grow faster than consolidated net income.

5. Tax Optimization

Effective tax rates have fluctuated over time. A lower tax burden in recent years can disproportionately benefit EPS.

Gold Star Investment

Constellation Software has delivered one of the most remarkable investment stories of the past two decades. Since its 2007 IPO, the company has compounded shareholder wealth at an annualized rate of over 33%, turning a $10,000 investment into more than $2 million.

Constellation’s financial metrics—including 20%+ annual revenue growth, 18%+ annual earnings growth, and an ROE consistently above 30%—underscore its status as a superior investment.

The numbers are impressive, but relative market performance is what matters to investors. How has Constellation performed against the alternative tech investments in generating shareholder wealth?

For U.S. investors seeking exposure to the technology sector with a focus on quality, durability, and consistent returns, Constellation Software is a paragon of long-term value creation.

Constellation Software Stock vs. the Megacap Tech Companies

Constellation Software has easily generated a higher CAGR than the U.S. megacap tech companies we adore today. Those megacap companies — MAG-7 in particular — that were publicly traded when Constellation Software’s ADRs appeared on the OTC market failed to keep pace.

Just as importantly, if not more so, Constellation has generated its superior returns with remarkably less volatility. Long-term shareholders have had been blessed with far shallower drawdowns. Indeed, during the worst bear market in recent history — that of late 2008/early 2009, Constellation Software experienced half the drawdown the the megacap tech companies.

Constellation Software v. The Newer Megcap Tech Companies

As for those darlings that arrived a little later, two have the upper hand with Constellation on CAGR. But, again, we must consider volatility (risk) and max. drawdowns. Constellation, again, has proven to be the less volatile investment. We all claim to have an infinite capacity for enduring pain until we’re actually in pain.

Market Performance: Constellation Software has left 99% of stocks in the dust since its IPO.

A $10,000 investment at its 2007 IPO would be worth well over $2 million today—an increase of more than 20,000%. This equates to a compound annual growth rate (CAGR) of approximately 33% per year—vastly superior to the S&P 500’s annualized return of about 7–9% over the same period.

Share Price and Market Capitalization

IPO (2007): Share price ~$50 CAD (equivalent to about $45 USD at the time, but Constellation reports in USD internally and in filings).

2025: Share price exceeds $4,900 CAD (about $3,600 USD).

Market Cap (2025): Over $75 billion USD (based on share count and recent exchange rates, but Constellation’s enterprise value and reported financials are in USD).

Important Note:

While the stock trades in Canadian dollars on the TSX, Constellation’s financial statements are reported in U.S. dollars. This means all revenue, earnings, and cash flow figures are directly comparable for U.S. investors without currency conversion.

Shares can be purchased directly on the Toronto Stock Exchange under the ticker CSU, but for those who prefer to keep their portfolios entirely in U.S. markets, the company is also available as an over-the-counter (OTC) American Depositary Receipt (ADR) under the ticker CNSWF. American investors can gain exposure with the same ease as any domestic stock, sidestepping currency conversions and international trading complexities.

And if you find the high price of Constellation shares off-putting (fraction ownership can be difficult to maneuver in OTC stocks), two funds, the TCW Compounders ETF (GRW) and the Akre Focus Retail (AKREX) mutual fund, feature Constellation as their top allocation.

Final Thoughts

Constellation’s founder, Mark Leonard, has cultivated a culture of decentralization and accountability. The company’s operating groups are given significant autonomy, which encourages innovation and responsiveness to local market conditions. This culture has been a critical factor in Constellation’s ability to integrate and grow its portfolio companies.

Constellation is known for its transparent and candid investor communications. The company’s annual shareholders letters and investor presentations provide deep insights into its strategy, performance, and outlook, fostering trust and long-term shareholder alignment.

Constellation Software’s performance since its 2007 IPO is a testament to the power of disciplined capital allocation, operational excellence, and a decentralized business model. The company’s ability to compound value at extraordinary rates has made it a standout performer in the global technology sector.

NOW FOR THE BOLD-FONT FINE PRINT: The text above should not be construed as investment advice. It is neither a solicitation nor a recommendation to buy or sell any security or investment mentioned. It is information only. I have opinions. What works for me might not work for you. Always remember the buck stops (and starts) with you, and you know you better than anyone, or at least you should.

DISCLAIMER: THE AUTHOR DOES NOT GUARANTEE THE ACCURACY OR COMPLETENESS OF THE INFORMATION PROVIDED ON THIS PAGE. THE INFORMATION CONTAINED ON THIS PAGE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.