Popular Bloomberg Columnist Agrees: Leveraged Stock Portfolios Are Worth Considering!

But we knew it all along.

I avoid hyping the other guy and do so with no envy or malice. I’m pragmatic.

I find it difficult enough to encourage you to come over here. To encourage you to go over there, well, it has always struck me as counterproductive, like peeing in the wind.

But I give credit where it is due, especially when it’s self-serving. So I credit Bloomberg opinion columnist Matt Levine and his popular Money Stuff newsletter (which I don’t believe he pimps on Substack).

Levine — Harvard grad, lawyer, former Goldman Sachs investment banker — is a Wall Street insider. Though most of what Levine muses about caters to other insiders, his peek-behind-the-curtains musings I find fascinating at times, nonetheless, because Levine so often confirms what I have always assumed: Wall Street’s quest for revenue borders on the avarice, which, I suppose, is true of many of us. The difference is, as Levine so frequently highlights, the Wall Street species is so fiendishly cleverer in adhering to the letter of the law while simultaneously annihilating its spirit in pursuing its quest. (Here’s a tidbit of this marvelous ethos in action.)

Most of the space Levine budgets in his newsletter strikes me as cautionary tale: Best for us on the outside to avoid the Wall Street questuaries we sometimes envy and should always distrust. (Who do you think will benefit most from Wall Street’s latest push to inculcate the hoi polloi on the indispensability of private equity and credit?) Levine will occasionally clear his throat of matters of a more practical nature. Leverage and investments was a recent clearing.

To wit, Levine featured a fetish of mine, leveraged stock portfolios, in a recent musing. An epiphany was forthcoming on my part. Levine highlighted an aspect of leveraged stock investing and its potential to solve a problem I had long ignored: The importance of owning stocks when it matters most.

Levine writes:

“When you are a young professional, you probably do not own a lot of stocks, but when you are near retirement you probably do own a lot of stocks, because you keep buying more stocks each year. Therefore, the amount of money you have in retirement will depend a lot on your investment returns when you are in your 60s, and much less on your investment returns when you are in your 20s.”

His commentary was inspired by readers noting this conundrum after a Levine article riffed on leveraging an investment portfolio with options, futures, and margin loans (all of which I avoid) in a prior newsletter. (I read the relevant article, and it strikes me that much of what Levine discussed is too Rube Goldberg-esque; too roundabout with too many moving parts that can go wrong, but that, too, is the Wall Street ethos.)

Time diversification was the aspect of leverage I (and apparently Levine) had ignored. That is, the financial benefit of owning a heap of stocks in youth as opposed to owning a heap in your dotage. The more stock you own when you are young, the less stock you will need to own when you are old. Many of us own too little stock when we are young. To compensate, we own too much stock when we are old.

The much-maligned leveraged ETF offers a possible remedy.

I’ll concede much maligned for a reason. The supermajority of these misfits are useless as long-term wealth-building investments and antithetical to the concept. They are speculative playthings at best that can prove profitable under the right circumstances for those with extraordinary market-time skills. (And who has that?) The supermajority of leveraged ETFs is bought to be sold.

Nearly all sector-leveraged ETFs undergo too much cyclicality, which rots returns with volatility decay and renders wealth creation employing a buy-and-hold strategy impossible. The newfangled single-stock leveraged ETFs have yet to be sufficiently road-tested like the other variants. My expectations are low. I doubt they’ll prove any more investment worthy than their leveraged sector brethren, and likely less so.

Bypass the supermajority, to be sure, but if your temperament permits, stop and ponder the superminority: the leveraged ETFs that track the S&P 500, NASDAQ 100, and Dow Jones Industrial Average. They are similar in kind to other leveraged ETFs but notably different in one magnificent aspect. The long-term trend of the underlying index is persistently up, and that’s a game-changing deal.

As for the superminority, I give you the “Big Three” — the leveraged ETFs that track the most heeded stock market indices. The select triumvirate can be considered investment-worthy for those with the requisite constitution. That is, worthy if you can stomach the volatility and your time frame is measured in decades, because there is a helluva lot of volatility, and there always will be. Time is an indispensable component.

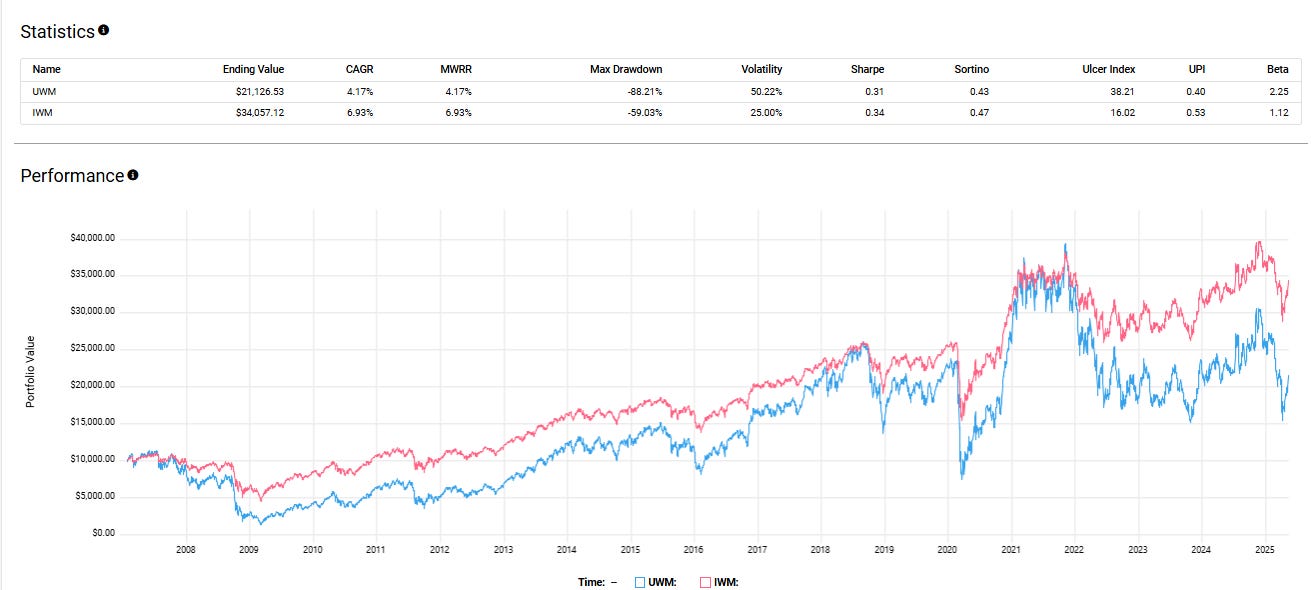

For good measure, I’ll toss in the straggler index, because we can. We’ll also consider the investment world’s version of the National Hockey League, or the trailing fourth member among the elite, the Russell 2000 represented by the (unleveraged) iShares Russell 2000 (IWM), the 2x leveraged) ProShares Ultra Russell 2000 (UWM), and the (3x leveraged) Direxion Daily Small Cap Bull 3X Shares (TNA).

Let’s kick off this exegesis with the 2x leveraged ETFs.

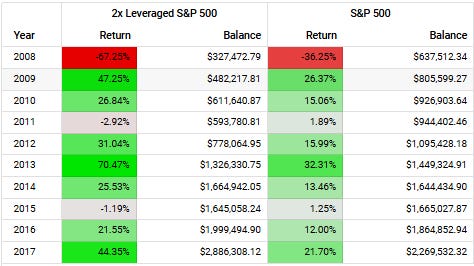

I find these leveraged renditions especially insightful because they are of older vintage. Just as important, these leveraged ETFs give us precedent to the impact of catastrophe and to the potential once government clears the deck of the systematic catastrophic ruins and erects an ample backstop to prevent the rest from backsliding into Hades. I refer to the 2008 financial crisis.

When the worst of the worst is included, the potential remains encouraging. Tomorrow will still arrive, and in time reveals it was better than yesterday.

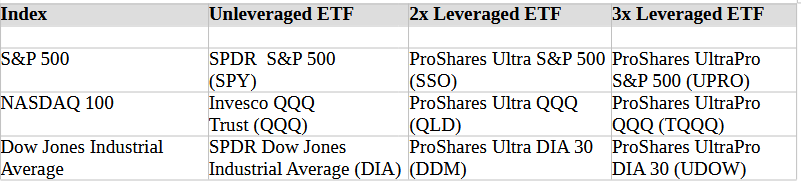

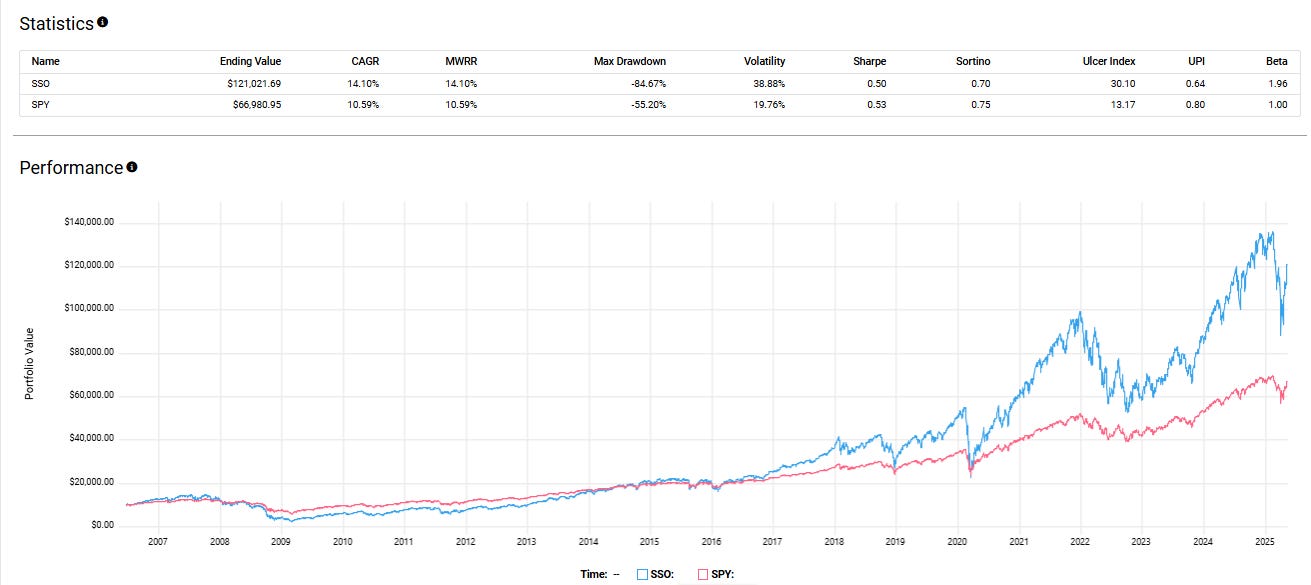

S&P 500 Unleveraged and 2x Leveraged

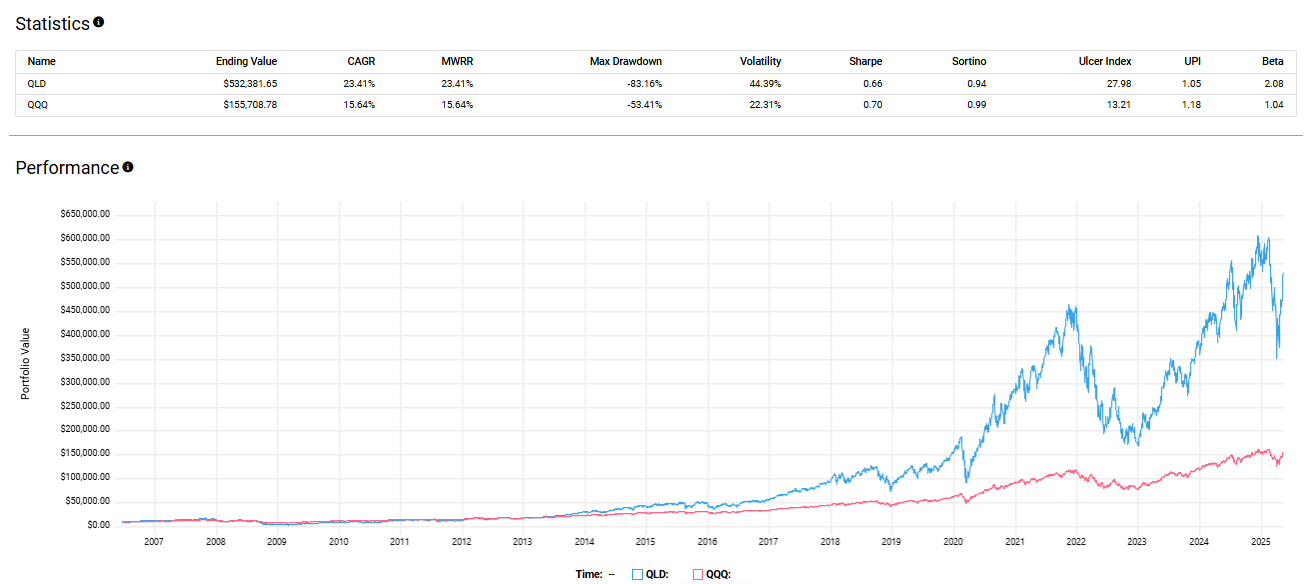

NASDAQ 100 Unleveraged and 2x Leveraged

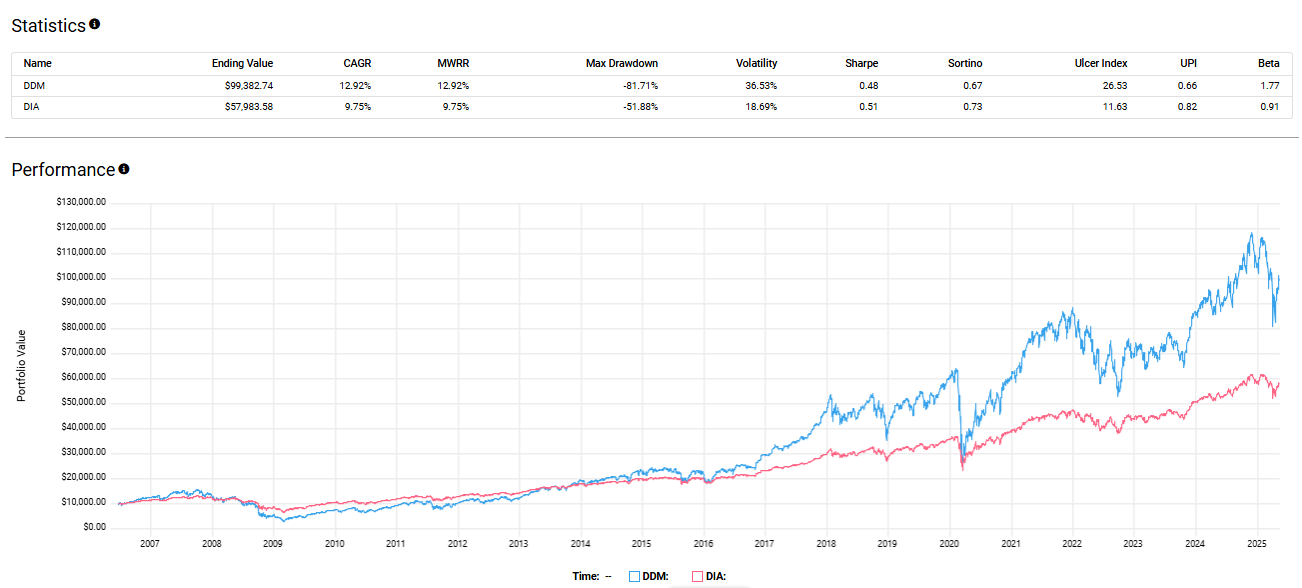

Dow Jones Industrial Average Unleveraged and 2x Leveraged

Russell 2000 Unleveraged and 2x Leveraged

But before you set out on the leveraged journey, assume wisely.

To assume you can endure an 80% drawdown on your $100,000 stock portfolio is one matter in theory. To endure an 80% drawdown and see $20,000 pixelated before your eyes in your broker account — that’s the stuff of existential crises. Let’s put some numbers to it and see if we can elevate the theoretical pain of an 80% drawdown to the visceral.

You roll into 2008 with a $1 million portfolio, and all of it invested in the 2x leveraged S&P 500 (SSO). You feel a bit chippy. Your leveraged portfolio was flat for 2007, but so was most of the market, but the year before, 2006, your leveraged portfolio generated a 26% return — 12 percentage points more than the unleveraged S&P 500.

Did someone say Black Swan?

One appeared out of the distant blue in 2008, with the swan reaching peak aggression by the fourth quarter of that year. Your leveraged portfolio paid the price. You rolled out of 2008, torn and frayed; your portfolio worth a third of its value when you entered the year.

And more was to come.

The new year, 2009, brought no relief. At the nadir, on March 9, 2008, your million-dollar portfolio was worth $180,000 — a little more than half of the third of the $1 million portfolio you dragged with you into 2008.

What’s a poor boy to do?

Nothing, if time is on his side. If it was, you were back to square one five years later, by mid-2013, with your portfolio again worth $1 million. Onward and upward you ascended. You caught and passed the unleveraged S&P 500 by the end of 2014.

By mid-2025 (today), the unleveraged S&P no longer appeared in the rearview mirror, having been left in the dust years ago. And you did nothing but wait.

The leveraged S&P 500 and DJIA have generated approximately 3.5 percentage points more CAGR than their unleveraged benchmark since their respective introductions. The 2x leveraged NASDAQ 100 delivered nearly 8 percentage points more CAGR. This is a very big deal (and benefit) when time is on our side.

We have an exception, because in life there always are.

The fourth member of the crew, the 2x leveraged Russell 2000 ETF, was the lone loser. Unlike the other three, it has yet to recover from the decade-long small-cap malaise. The CAGR of the 2x leveraged ETF continues to trail the CAGR of its unleveraged benchmark to this day.

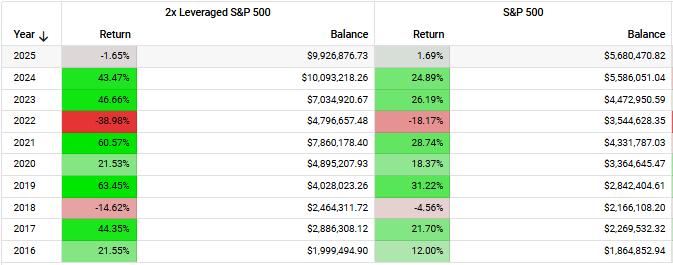

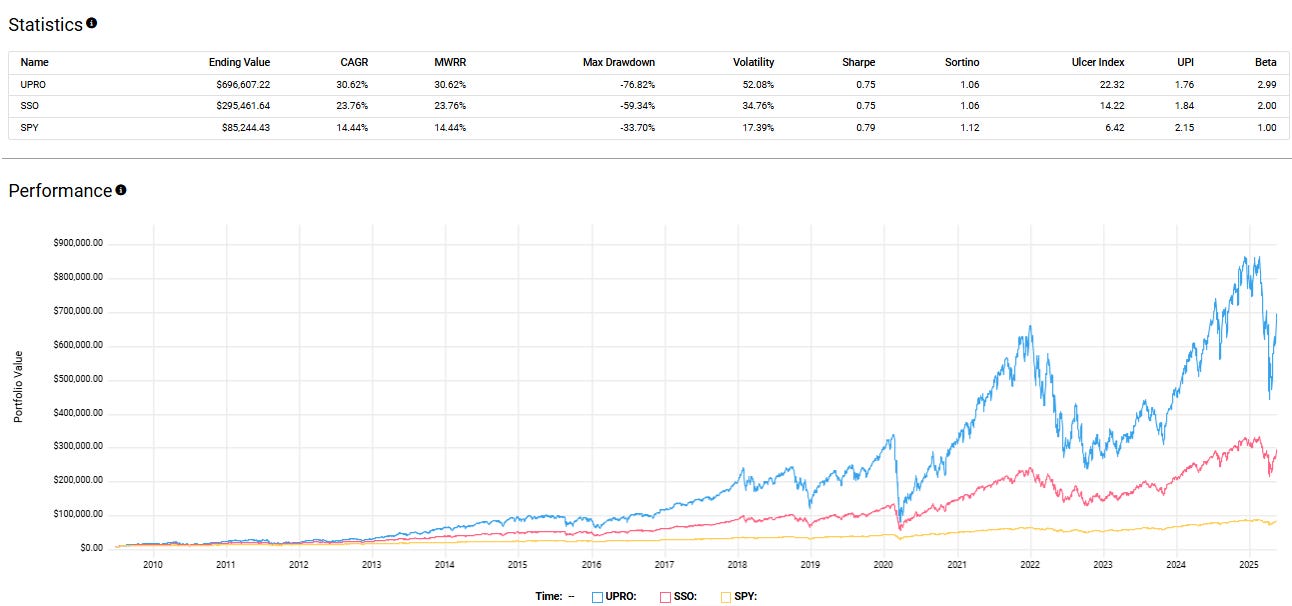

Understanding the potential embedded in these leveraged monsters and the marketing appeal, the sponsors upped the ante. The 3x leveraged ETFs were introduced soon after the 2008 apocalypse and memories had sufficiently blurred — in other words, a year later.

Let’s take a gander and see how it has all unfolded with the leverage, more leverage, and even more leverage ETFs over the past decade and a half.

We lack a correction of the 2008 magnitude, but we see the performance over two notable market corrections — the Covid-induced bear market of 2020 and the interest-rate induced bear market of 2020. These were less apocalyptic than the 2008 financial crisis, but some unpleasantness needed to be endured.

S&P 500 Unleveraged, 2x Leveraged, and 3x Leveraged

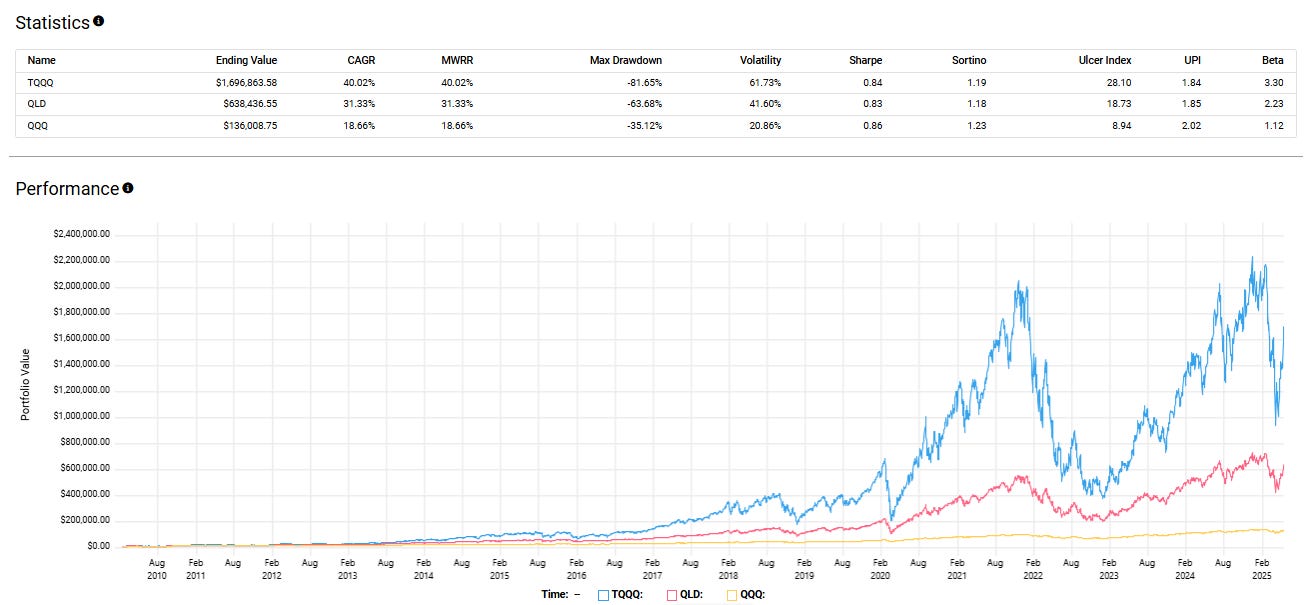

NASDAQ 100 Unleveraged, 2x Leveraged, and 3x Leveraged

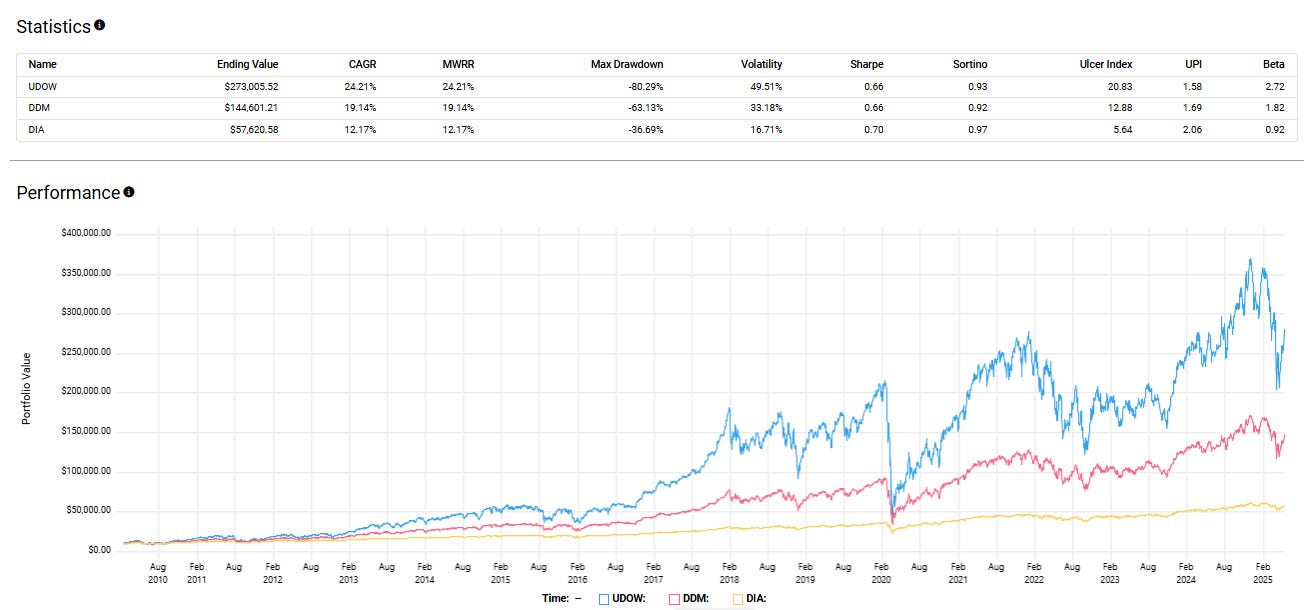

Dow Jones Industrial Average Unleveraged, 2x Leveraged, and 3x Leveraged

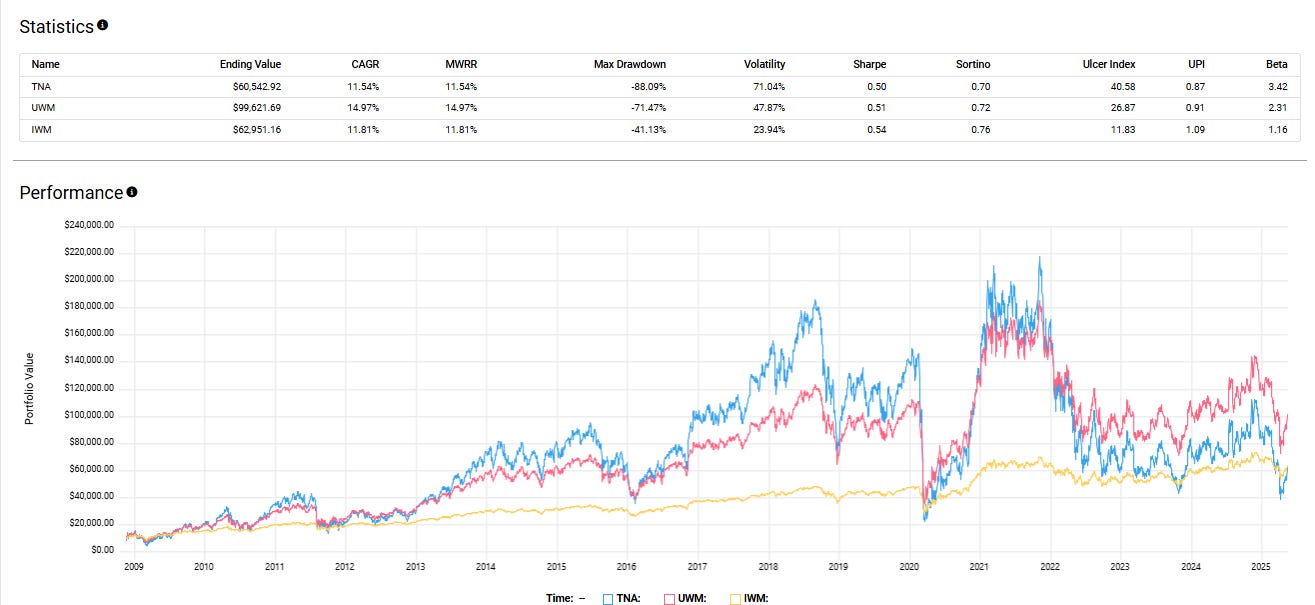

Russell 2000 Unleveraged, 2x Leveraged, and 3x Leveraged

No matter, unleveraged, 2x, or 3x the differences in terminal wealth are stark.

The leveraged ETFs on the S&P 500, NASDAQ 100, and DJIA finished miles ahead of their respective unleveraged index. (For the record, I realize the DJIA is an average, not an index.) The 2x leveraged ETF generated 50% more CAGR than the unleveraged index; the 3x leverage generated twice the CAGR. That’s a very big deal over time. (Indeed, the 3x leveraged TQQQ turned $10,000 into $1.6 million over the past 15 years.)

We again have our exception, and it’s who we expect. Over the same spam, the small-fry Russell 2000 remained small. The 3x leveraged ETF failed to match the unleveraged index. The 2x leveraged version, on the other hand, beat both, though by a trifling shake given the volatility endured.

The great investing conundrum through time immemorial is how do I assure I’m all-in on stocks when it matters — during my callow, poverty-addled youth when I have nothing but time? I lack the funds, but if I couldn’t care less about the volatility, I should be all-in and then some. Leverage applied intelligently enables the intrepid, well-grounded youth to get in and then some.

For instance.

You’re 20 years old and you have $5,000 saved. You open a Roth IRA. You invest your net worth into a 3x leveraged S&P 500 ETF, giving you thrice the daily exposure compared to the unleveraged benchmark, and then you let it run for the next 35 years.

Had that 3x leverage ETF generated a quite reasonable, and possibly conservative, 18% CAGR along the way (the 3x leveraged S&P 500 has a 30% CAGR over its 16-year existence), you’d roll into your mid-50s with $1.6 million in your Roth IRA. That $5,000 is all you contributed. Because you were sober and chaste on matters financial in your inchoate youth, you no doubt invested much more over the subsequent 35 years.

(Sidebar: Another consideration supports my suitability hypothesis. None of the leveraged ETFs tethered to one of the four major indices has had to reverse split its shares to preserve its exchange listing. On the contrary, they have all split their shares on price advances. This suggests volatility decay is less of a threat compared to the leveraged sector ETFs, nearly all of which have to reverse split their shares to preserve their listing.)

But who says you have to go all in?

You can find other publicly traded imperfectly correlated assets — Treasury securities and gold, for instance — to mix and match to lower the volatility and temper the fright of the max. drawdown horror show. (I have written numerously on the subject of leveraged ETFs in these pages to the point of ad nauseum. Type “leveraged ETF” into the search bar and I’m sure something pertinent on the matter will materialize.)

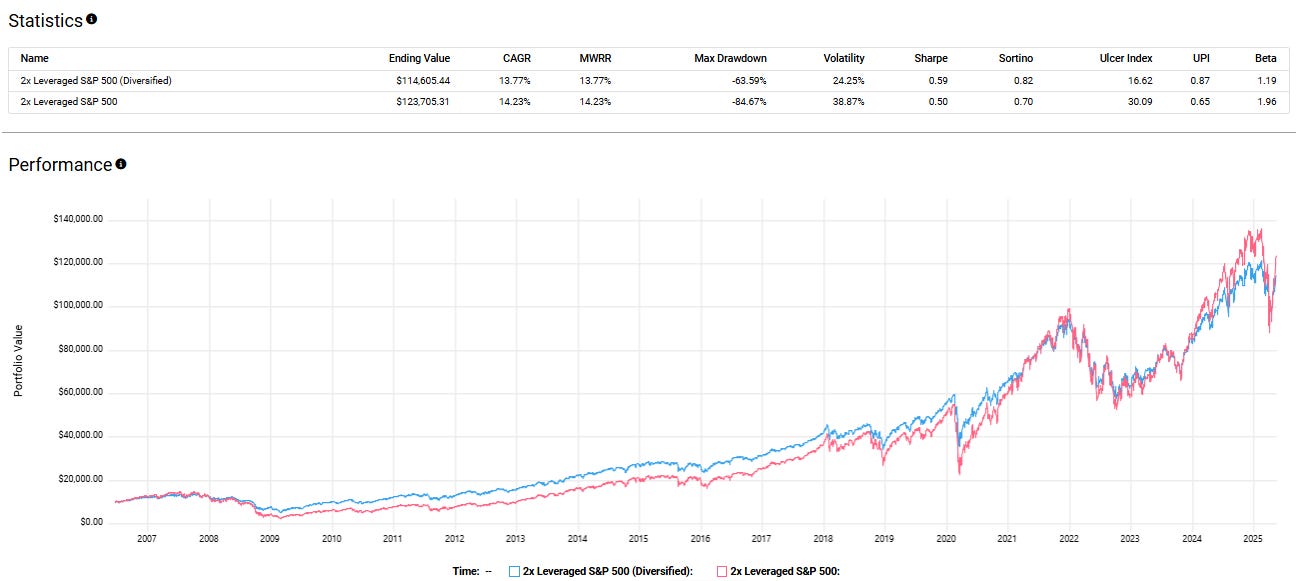

By me simply mixing and matching and tossing it all against the wall to see what might stick, I was able to cobble together something that tempers the volatility and drawdowns without sacrificing much CAGR.

The chart below is composed primarily of 2x leveraged S&P 500 with volatility tempered by allocations to Treasury securities and gold compared to the straight 2x leveraged allocation.

My examples are tidy, convenient, extrapolative, and, of course, wrong, as are all predictive examples of the kind. But informative, nonetheless. They enable us to set reasonable expectations while considering the potential profit and pitfalls.

I understand that youth, having been there, reflexively bristles at the thought of his 60-year-old incarnation. I get it. The younger version views the older version as an imposition, a burden, a killjoy.

The younger version isn’t wrong, but if sufficiently mature, must consider that this imposition, burden, and killjoy will be him, God willing, as impossible as this seems in the bloom of youth. You may resent the older you as you resent your parents, but you have to embrace him or her sooner or later — better sooner.

Time is not always on our side. It was on the Rolling Stones side when they first claimed it so 60 years ago. But how sneaky time is about getting away, as the Rolling Stones have proven time and again on their recent cringe-inducing concert tours and since their last decent album, Some Girls, 47 years ago. That said, perhaps you have more of it than you think.

(Sidebar: I’m neither Gen Z nor Millennial. I'm on the tail end of the Baby Boom generation. I have dedicated a slice of my investment portfolio to leveraged investments, specifically the ETFs mentioned. My dedicated leveraged portfolio slice is housed in a Roth IRA, and the portfolio is every bit as volatile as the historical data suggest. But that’s OK. Though an early-stage sexagenarian — easy now — the portfolio is appropriate because it’s not for me. I’ll never tap it. It is a legacy portfolio destined to benefit the next generation and hopefully beyond. I, too, in this instance, have time on my side like our callow, poverty-addled youth. At least I think so.)

NOW FOR THE BOLD-FONT FINE PRINT: I have no business relationship with any of the ETFs sponsors or analytical tools mentioned. They don’t know me; I don’t know them. DYR (Do Your Research). I am not your investment advisor. The text above should not be construed as investment advice. It is information. I have opinions. What works for me might not work for you. For most people, the investments and strategies are inappropriate because of the risk, amplified volatility, and discipline required. Always remember the buck stops (and starts) with you, and you know you better than anyone. or at least you should.

DISCLAIMER: THE AUTHOR DOES NOT GUARANTEE THE ACCURACY OR COMPLETENESS OF THE INFORMATION PROVIDED ON THIS PAGE. THE INFORMATION CONTAINED ON THIS PAGE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.