How to Destroy Your Investment Portfolio (And Retirement) in One Easy Step

Don’t just do something, stand there!

No, I haven’t mangled a familiar trope.

When events turn chaotic, people get desperate to act, to remedy the situation, or at least relieve the discomfort. Expediency is the order of the day because none of us revels in pain – physical or mental.

The markets suffered a convulsive, discomforting fit earlier this month, leaving the S&P 500 Index NASDAQ 100 Index down 6% and 8%, respectively, after an especially bouncy three-day tempest that saw the CBOE Volatility spike to 65. Was the market capitulating? Should I do something? Many answered affirmatively on both. (Wharton School’s Jeremy Siegel took to CNBC to implore the Federal Reserve to cut immediately the federal funds rate by 75 basis points. God forbid, stocks should trade lower.)

I find it strange that adults so often perceive time as a child, conflating a month with eternity. But here we are three weeks later, and it’s as if nothing happened. Stocks have reclaimed all the lost ground and then some. The episode has been purged from the memory, even the knee-jerk inclinations to “do something” and to reallocate the portfolio seem a dream. Today is forever.

But I remember, as I remember the bear market of 2022, the market correction of 2019, and the Hurricane Agnes of a financial crisis, market selloff, and the recession that ripped across the country in 2008 and 2009. Do something, dammit! Do something!

Market corrections are always the wrong time to question your risk tolerance and investment portfolio’s risk-return profile — to do something, in other words. And yet it’s the time most investors question (as recently as three weeks ago). The primary reason for the sudden doubt in faith is that investors overestimate their risk tolerance when times are good.

The good news for the emancipated adult is that discipline and perseverance can compensate for all but the most ridiculous portfolio allocations. Stick to your guns. After all, your guns got you here, so it can’t be that bad.

I know from experience. I have been doing this for 35+ years. When it’s all good, investors want only to buy and when it’s all bad, they want only to sell. Recency rules. It’s human nature that inevitably repeats. Many investors swear this time is different: the markets are down and down for the count. Dystopia is the new reality.

It never is, and if it is, your portfolio is the least of your worries. You have to play it as if it will return. You have no choice. Many, though, inevitably see it otherwise: get me in at the market top (Utopia here and forever more), get me out at the market bottom (nothing but Dystopia until the end of time).

Perception is often distorted in a market selloff. Here’s the reality: An intelligent portfolio will get you through, even if that portfolio’s sole investment is an S&P 500 Index fund — a somewhat diversified large-cap equity portfolio.

2008 may have been the worst year to retire of the past 50. The markets were rumbling from the rumors housing’s foundation was shaky and the mortgage debt backing housing was no longer investable. The rumors proved true, and all hell broke loose in the fourth quarter of 2008.

The U.S. financial system – imbued with leverage backing mortgage securities of questionable quality – approached the precipice. Bear Sterns and Lehman Brothers collapsed with the flare of a dynamited Las Vegas hotel. And if the U.S. Treasury Department and Federal Reserve had not stepped in, the other major Wall Street investment banks, along with the major commercial banks, and many large P&C insurers would have followed suit.

(Sidebar: Panics and major market selloffs are always, ALWAYS instigated by leverage. Leveraged investors are the first to head for the exits when the market turns. Monkey see, monkey do, because everyone wants to avoid a margin call. One leaves and then another until a cascade ensues. Unleveraged investors, seeing their portfolio shrink, are anxious to limit the damage. Many join the queue. And it was all instigated by leverage.)

“If you can keep your head when all about you are losing theirs…,” so Rudyard Kipling began his famous poem “If,” you’ll be extruded from the other end shaken and stirred, but no worse for wear and tear. Here’s what I mean.

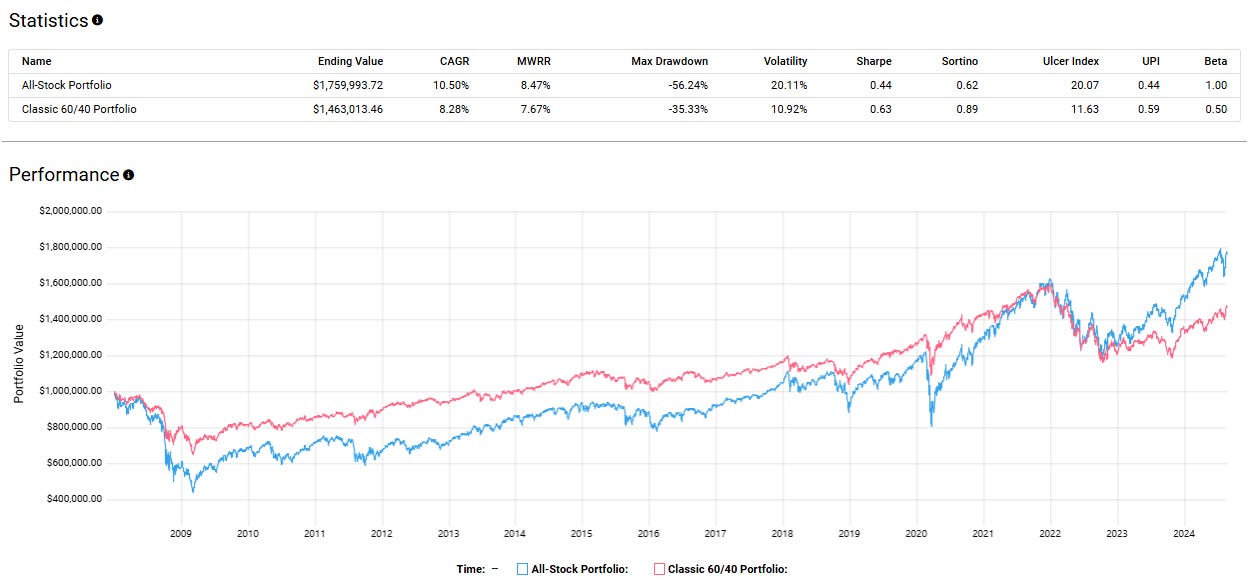

Let’s assume you retired at the start of 2008 at age 65 with a $1 million investment portfolio — the product of continually investing in an S&P 500 Index fund. You maintained this simple allocation, even though you have retired. You consider your antecedents as factors in maintaining the allocation. Mom and Pop are still treading earth, and both are in their 90s. You assume, reasonably, that you are a nonagenarian in the making. Heredity suggests you could still be kicking it for another 30 years.

Let’s assume you stay with your S&P 500 portfolio allocation, and you’ll need to draw on that portfolio. What’s more, you opt for a 6% annual drawdown, predicated on the $1 million balance at the onset of retirement. You decide to withdraw $5,000 each month until the day you bid the world adieu.

Or perhaps not. You decide the vicissitudes of an all-stock portfolio are no longer for you. You are, after all, no longer contributing to the portfolio. You downshift the risk profile. You reallocate to the classic 60/40 portfolio – 60% S&P 500 Index and 40% U.S. Treasury securities. You hold to the 6% annual drawdown based on the same initial portfolio balance, so $5,000 per month it is.

Here we are 16 years later, and you have celebrated your 81st birthday. You held firm, you continually withdrew $5,000 each month. How would you have fared had you held to all stocks; how about if you had switched to the classic 60/40 allocation?

Either way, you would have endured some anxiety, and right from the get-go, though one portfolio was more anxiety-inducing than the other. We shouldn’t be surprised.

At the market bottom in March 2009, the $1 million S&P 500 portfolio had withered to $437,000. And keep in mind you had been retired only 14 months. Had you gone the more conservative route with the 60/40 allocation, you’d be mulling the prospects of a $646,000 portfolio.

But you heeded Kipling’s advice. You kept your head. You maintained your portfolio allocation – either all stock or stock and Treasury securities – and because you kept your head, you’re once again sitting in high cotton, and even higher cotton than in 2008.

Despite a severe market correction and your continually withdrawing $5,000 each month, your 2008 $1 million portfolio is worth more today. The miracle of compounding and the tenacity of a growing economy have enabled your S&P 500 portfolio to grow to $1.7 million. And had you ratcheted down your risk preference to the more placid 60/40 allocation, your portfolio would still be worth a respectable $1.4 million.

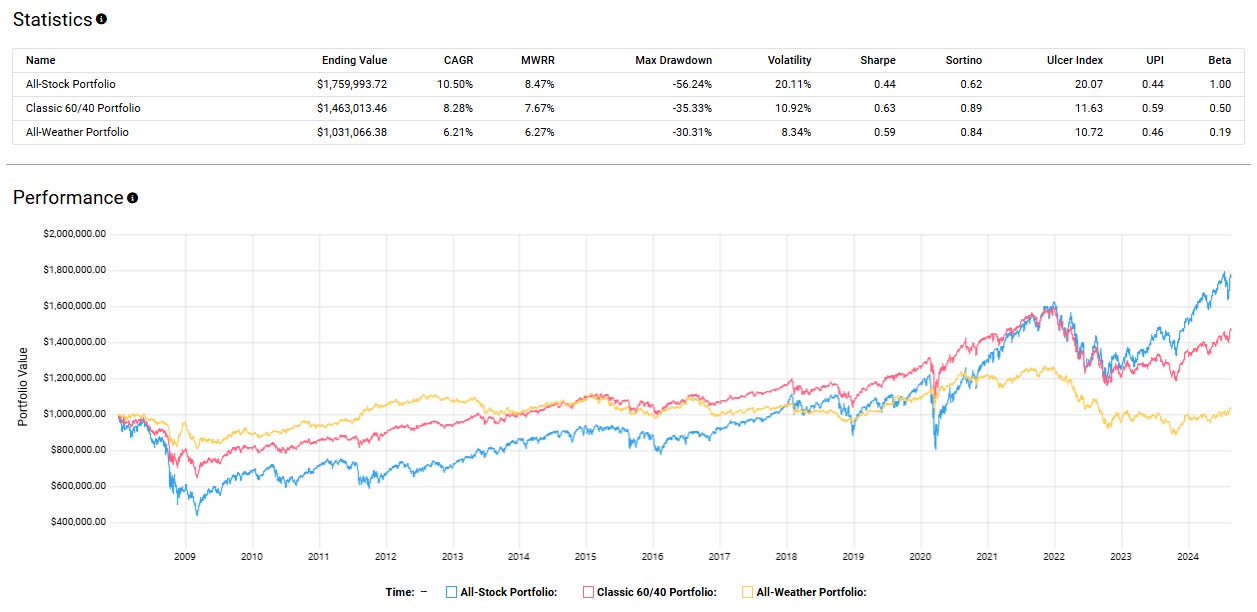

And let’s say you further ratcheted down the volatility. You reallocated your portfolio to the All-Weather portfolio devised by Ray Dalio that has gained currency with conservative investors. The All-Weather portfolio is composed of 30% stocks, 40% U.S. Treasury bonds, 15% U.S. Treasury notes, 8% gold, and 7% commodities.

Low volatility is the upside to a conservative allocation — the more conservative the allocation, the lower the volatility. The All-Weather portfolio merely drooped to $823,000 at the worst of it in 2009.

Conservatism comes at a price, though – lower long-term returns. That said, you’re OK. You would still own a portfolio worth $1 million in August 2024, and you have been withdrawing $5,000 each month. A price must be paid for more restful nights, but who are we to say the price isn’t worth paying? (Here are a few more popular portfolio allocations to consider.)

None of these portfolios is wrong or irrational. Risk tolerance is bespoke. The knowledgeable, rational individual knows best what he can tolerate. Knowledge and rationality increase the odds of maintaining your head when all about are losing theirs.

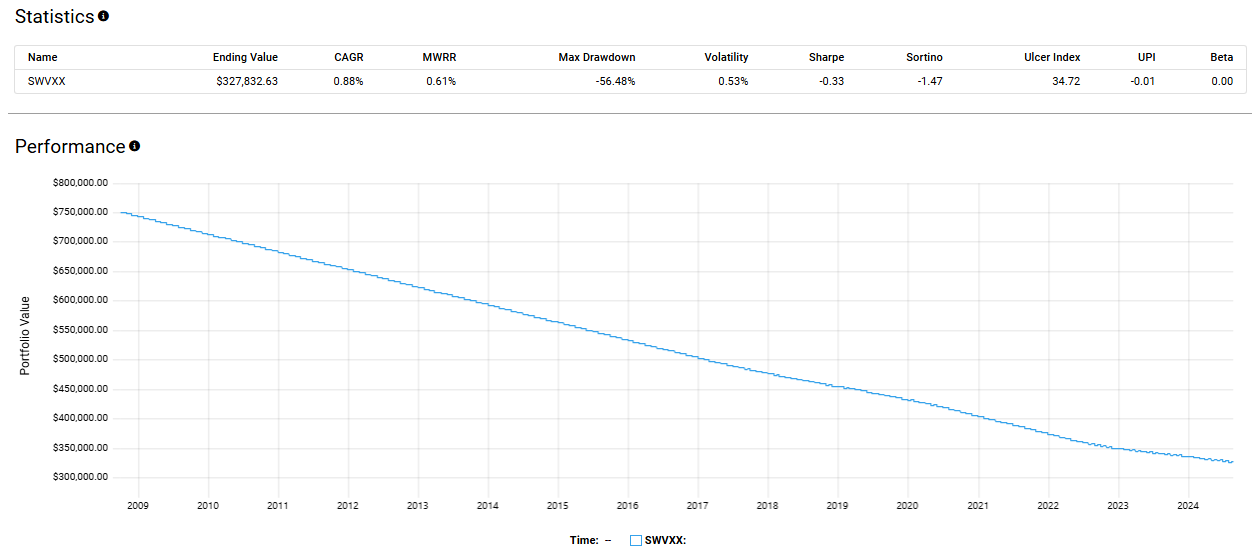

But what if you were dishonest with yourself? You discovered during the 2008 bear market you had overestimated your risk tolerance. Your portfolio had lost 25% of its value heading into the fourth quarter of 2008. You decided to cut your losses and dump everything (I know people who did this) and stuff it all into a no-volatility money market fund. You were sufficiently rattled to even switch to the more conventional 4% drawdown based on the lower $750,000 portfolio value. You reduced your monthly withdraws to $2,500.

How are you doing?

Not so good. A $750,000 investment portfolio allocated only to a money market fund with a conservative 4% annual drawdown (based on the initial balance) would be worth $328,000 today, even though you’ve been withdrawing only half what you could have been withdrawing had you stuck with one of the more volatile, higher-return alternatives.

Here we are again with proof positive that nothing good comes from panic and impatience. You got out, but you could never quite muster the fortitude to get back in. The timing was always wrong. The market continued to rise, and you were nowhere to be found.

“What a big price to pay for a little show of temper,” said Captain Bligh to Fletcher Christian. How true.

A couple thoughts to help you maintain your equanimity through the next bear market. And there will be a next bear market.

Finance is as evergreen as it gets. The details and playthings will change over time. Wall Street excels at developing diversions — infinite derivative iterations — to entertain and separate you from your money. But the fundamentals remain immutable: equity, debt, and leverage. That’s it, and that’s all there ever will be. Intelligent portfolios composed of equity and debt (and even a goosing of reasonable leverage) that worked 100 years ago will work 100 years in the future.

But the payoff occurs only after you have endured the pain. Zero-volatility portfolios are zero-return portfolios. This hard fact is true everywhere: fitness, work, health, diet, relationships, any aspiration. Risk tolerance — or pain tolerance, if you prefer — correlates positively with the payoff. No one is paid for merely existing.

(Sidebar: A $1 million investment portfolio is within the realm of everyone reading this. If you had started to invest $200 monthly in an S&P 500 ETF in a tax-deferred (traditional) or tax-free (Roth) retirement account 30 years ago and then doubled the contribution to $400 after five years and then doubled that to $800 five years later, your portfolio would be worth $1.1 million. A $200 monthly contribution is 6% of a $40,000 annual gross income. A $400 monthly contribution is 6% of an $80,000 annual gross income. An $800 monthly contribution is 6% of a $160,000 annual gross income. Perhaps more realistically we are talking 10% of a $96,000 gross annual income on the back end. We are older in the later years, and we should be more settled and further along in our careers. It can be a stretch, I’ll concede, but if the gauntlet runs from age 30 to age 60, you would be age 40 by the time the $800 monthly contribution rolled around.)

DYR (Do Your Research) I have opinions, but I am not your investment advisor. What works for me might not work for you. Always remember the buck stops (and starts) with you.

DISCLAIMER: THE AUTHOR DOES NOT GUARANTEE THE ACCURACY OR COMPLETENESS OF THE INFORMATION PROVIDED ON THIS PAGE. THE INFORMATION CONTAINED ON THIS PAGE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

I recently started to read them too, and I echo Jean's comment, it is really enjoyable content.

I recently started reading your articles and enjoy them so much, can't wait for the next one. I am a CFA Charter holder as well!